Written by Mae Price

Being a student often means trying to make $20 stretch for five days. Between rent, food, and trying to have a social life, the struggle can feel very real.

But saving money doesn’t have to mean saying goodbye to all the fun stuff. It’s about being smart, not stingy.

Here are some tips and tricks to help you save money as a student, without sacrificing your sanity (or social life):

Budgeting

Knowing where your money goes, helps you stop wondering where it went. You can track your spending using budgeting apps or just a notebook. Start by prioritising essentials such as rent and groceries, then set aside some money for your ‘guilt-free spending’

Student Discounts

Your student ID is basically a golden ticket. Flash it at cafes, cinemas, retail stores, and even public transport. Better yet, sign up for platforms like UNiDAYS, Student Edge, or Student Beans to access discounts on everything from tech and food to clothing and travel.

Meal Prepping

If you’re constantly buying takeout or grabbing food on campus, those small purchases add up fast. Get into the habit of meal prepping once or twice a week—pastas, burrito bowls, and stir-fries are your best friends. Bonus: You’ll eat healthier and save time during your busiest study days.

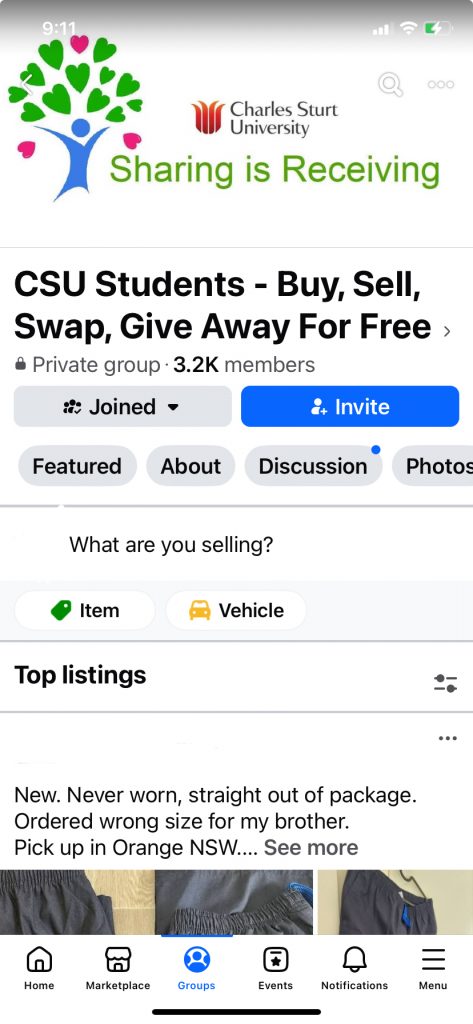

Buying Second-hand

Sometimes study essentials such as textbooks and uniforms can be pretty costly. Buying second hand textbooks or uniforms can save you a lot of money.

Free Stuff

Many students forget just how much free stuff is available on campus. From gym access and counselling to career services and student events (often with free food!), don’t miss out on what you’re already paying for through student fees.

Work

A part-time or casual job is the obvious option, but also think outside the box: tutoring, pet sitting etc. Even a few hours a week can give your bank account some breathing room.

Saving money as a student isn’t about cutting out all the fun—it’s about choosing what really matters. With a few smart habits, you can get through your degree without constantly stressing about your bank balance.

Charlie blog is a SSAF funded initiative.