Written by Shristi N

Being a university student often means juggling demanding coursework and a social life, while prioritising health all on top of the financial responsibilities.

Everyone knows that avoiding takeaways and shopping at Aldi can and does take you far but sometimes this is not enough.

Here are some ways I save money while being a university student.

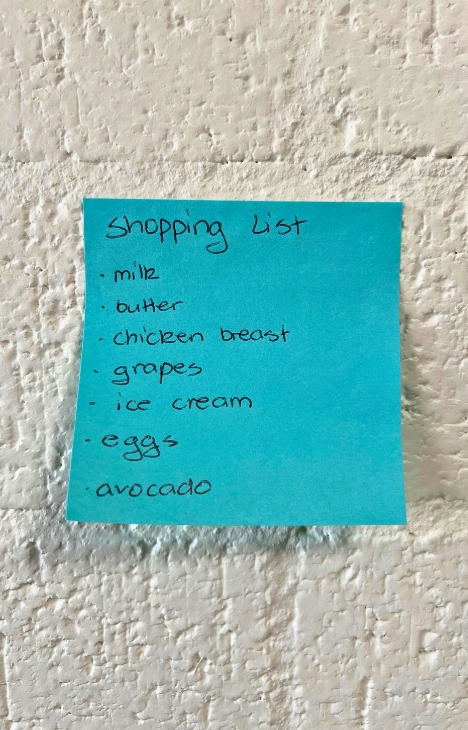

Plan your grocery list

If I got a dollar for each time I doubled up on grocery items, I swear I’d be rich.

Take the time to go through the pantry, fridge and freezer and take a literal stock-take of what you have.

I plan my meals from this list and focus on what I have already. Only after this do I make a grocery list full of ingredients that I absolutely need.

Bonus tip: I go grocery shopping on weekdays and find some bargains like discounted bread, meats, sweet treats and salad mixes.

Just keep in mind use-by and best before dates!

Bulk meal prep

First step is to plan your grocery list, but the second step is to plan your meals. If done correctly you can honestly plan for the whole week, and this is my biggest money saver.

When I plan my meals, I think of two things: food as fuel and food longevity. With this approach, I ensure each meal has one to two vegetables, a protein source, and a carbohydrate source.

I pop meals into the freezer so that it lasts longer. So, I add seasonings and sauces to make sure once thawed and warmed up again, it tastes as amazing as freshly made.

To me a few hours on a weekend saves me an hour every night that I use to study or socialise instead; bettering my health as well.

Other money saving tips

Food is my second major expense hence the focus on food. However, below I have complied a small list of things I do that can save some money that aren’t food related.

- Track expenses and Budget:

I look at my bank statements and see where I am spending my money so I know where I need to budget better. - Student Discounts:

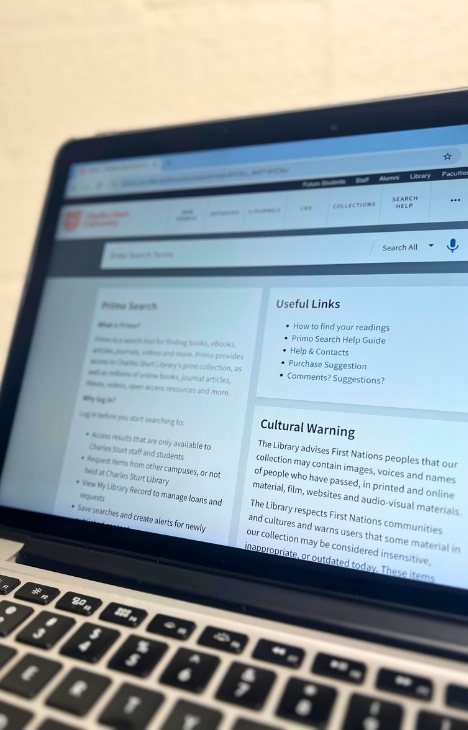

There are so many places that offer student discounts. I always carry my student ID on me and ask at stores just in case there is one. There also are a few apps dedicated to student discounts. - Utilise Library Recourses:

I can’t remember the last time I bought a textbook. I always borrow the textbook from the university library or utilise the free online version of the textbook that the university provides. - Scholarships:

Charles Sturt University offers so many scholarships for their students. Have a look into which scholarships you can apply for.

All of these tips can help university students gain financial stability.

With less stress and tension from financial responsibilities, we can focus on our coursework, or ‘afford’ a more active social life and ultimately prioritise our health.

Charlie blog is a SSAF funded initiative.