Written by Olivia Baker

Hi I’m Olivia and I have been a student of Charles Sturt University for the past 5 years.

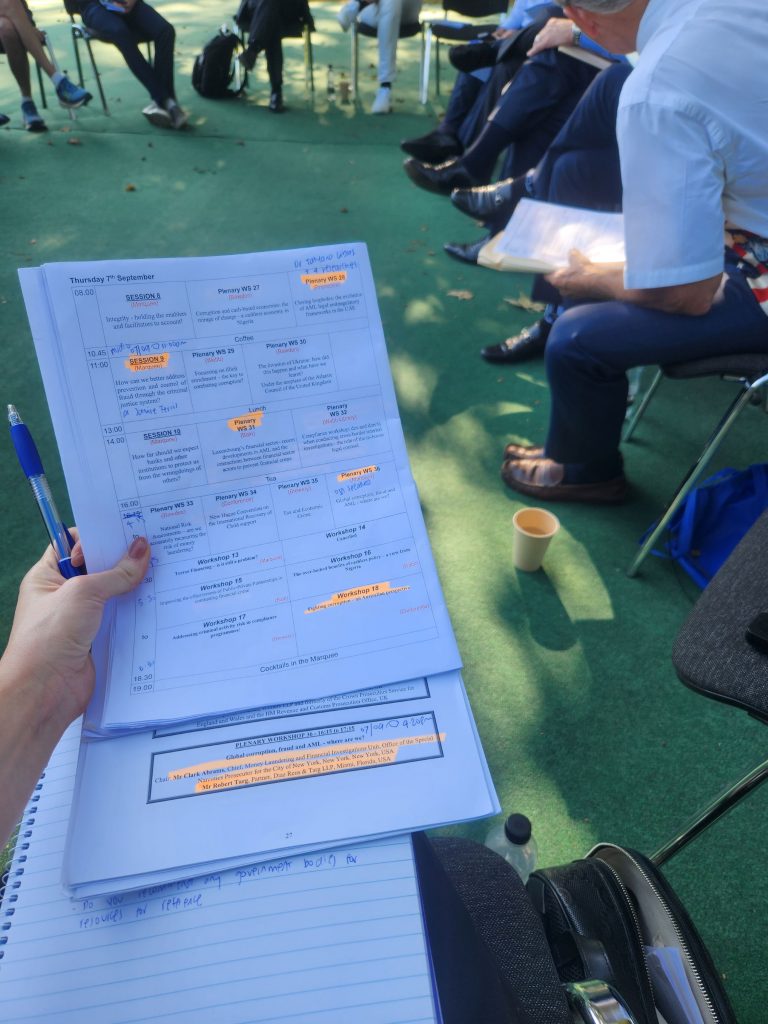

In my time I have come to learn the art of self-education deductables which are applicable to my tax return.

Including tuition fees, courses/micro-courses, conference/seminar fees, textbooks, stationary, office/study furnishings, computing devices, postage, student fees, a portion of my phone bill, accommodation and meal expenses for self-education costs incurred for travelling away from home.

At the beginning of each financial year following the lodgement of my most up-to-date tax return, I will create a template, acknowledging each subcategory outlined above so that I can keep a detailed list of transactions made throughout the year.

This record-keeping process allows me the opportunity to lodge my tax return seamlessly, without the need to decipher receipts and banking history to calculate my university deductions accurately.

Each year I have engaged the assistance of an accountant to lodge my tax return (also noting that this expense is an applicable deduction that is claimed under the category titled cost of managing tax affairs).

Doing so allows me to not only gain an understanding of the inner workings of how the tax return process works but inspires me with great knowledge to further fine-tune my deductable list for the following financial year and provides me with gratification in knowing my tax return has been submitted correctly.

When you are lodging your tax return, I urge you to hire an accountant, as they make the lodgement process an absolute breeze and aid with any complexities.

Keeping up to date with my tax returns each year, being organised, completing the lodgement on time, and ensuring I add student-related purchases to my deductables throughout the year allows me to lodge my tax returns with ease and obtain the best possible return to benefit my bank account.

I highly recommend you try the same method, as it has lifted a weight off my shoulders come tax time for the past 5 years.

Charlie blog is a SSAF funded initiative